FDNY Active

& Retired of Palm Beach

Meetings will normally be held on the second Thursday of the month

Our First meeting

Thursday, Nov 13 from 12 - 3

New Location

American

Legion Hall

American

Legion Hall

571 West Ocean Ave, Boynton Beach

Put it in your GPS

DIRECTIONS:

BOYNTON BEACH BLVD COMING FROM THE EAST:

Light at S.W. 8 th Street MAKE LEFT* Then make LEFT on W. Ocean Ave.

BOYNTON BEACH BLVD COMING FROM THE WEST

Light at S.W. 8th Street MAKE RIGHT* Then make LEFT on W. Ocean Ave.

*Note Checkers Resturant is on corner of SW 8th St and Boynton Beach Blvd.

IF YOU HAVE ANY QUESTIONS CALL DAVE ZYSMAN 561 512-4273

If you would like to become a member just come to a meeting or e-mail us at...

Dave Zysman - Zman7151@yahoo.com

![]() or Tom Guldner - Fireny@aol.com

or Tom Guldner - Fireny@aol.com ![]()

Click here to download an application to print and bring to meeting or email it.

///// Dues are due! $25. - Please pay up

FDNY 343 license plates were made available by Joe Holland.

Joe lost his son on 9/11 and has been instrumental is creating a 9/11 monument on Florida's west coast. The plates sell for $15 with the proceeds going to the 9/11 memorial. If you would like to purchase one or more of these plates E-mail Joe with your name and the number of plates you want.

Medicare Advantage News

This is the link to the NYC Organization of Public Service Retirees

Join and support

NYC Organization of Public Service Retirees (for Benefit Preservation)

Join the NYC Organization of Public Service Retirees (for Benefit Preservation)

Retired Members Association of the New York City Fire Department

Information of Interest to NYC Firefighters Living in FL

UFOA-Unitedhealthcare Dental

Starting January 1, 2023

UFOA Dental Providers Under Unitedhealthcare Dental PPO 20 Network Click here

UFOA Retiree Dental Benefit Increase Click Here for details

UFOA Optical Plan Info Click Here

Find & compare providers near you click here

Actions needed to be taken by spouse

upon the death of a member

I have recently had to deal with the problems faced by the wife of a neighbor after her retired FDNY spouse passed away.

Nothing had been prepared in advance and the widow was not aware of any actions she needed to take to insure proper notifications and, more importantly, protecting and continuing her future benefits.

I had several documents outlining the procedures a widow should follow but my copies were over 20-years old.

I contacted Paul Iannizzotto from the Broward retirees who has been on top of union and retiree details. He was able to get newer versions of the actions needed to be done by the widow of a deceased member. The UFA and the UFOA have different packets. A link to each is below.

Please go over this with your spouse and try to fill out as many forms as possible in advance and gather the necessary documents (marriage certificate, military discharge, Insurance account numbers, dates of appointment and retirement, pension numbers, units worked, etc.

If you're in the Catastrophic Insurance program be sure your spouse knows how to continue the coverage. (She will have to make payments herself).

Make a folder with all the forms, documents and phone numbers needed and go over it with your spouse so she will know the steps to follow.

Click on booklet needed

Notification Information and Fillable Forms

Upon Death of Spouse

Thank you Paul Iannizzotto for getting these documents for us.

Catastrophic Insurance Deductable

Here's the new address to submit your Amba Catastrophic Insurance claims. This is for both UFA and UFOA claims.

(UFA or UFOA) CATASTROPIC CLAIM

AIG BENEFIT SOLUTIONS

P.O. BOX 81879

CLEVLAND, OHIO 44181

There was a Catastrophic Insurance discussion at a meeting last year involving what expenses can be used to meet the $10,000 deductible.

Here is a quote from a previous statement about this which I believe came from the Union……….

"It has come to our attention that some retirees do not understand the deductible clause of the Catastrophic Insurance we purchase through the unions. There is a $10,000 deductible that must be met before the Catastrophic Insurance will cover the cost.

However, the deductible is not out of pocket expenses. Any expenses occurred even if they are paid for by Medicare or your secondary insurance coverage count toward the deductible. The money does not have to come out of your pocket.

It does not take much to meet the deductible. A few days in the hospital, an MRI, Cat Scan, blood tests and doctor visits will quickly meet the deductible. After that everything you must pay out of your pocket is covered. Keep in mind you can get a second opinion from a doctor or hospital covered by your plan.

" Note: I recently (1/10/19) called MARSH, who administers the Catastrophic Insurance plan and was told that this is correct. ANY expenses are used to meet the $10,000 deductible even if provided for by insurance. Once that is met, they will cover out-of-pocket expenses. You must keep all receipts and very accurate records of all expenses. Take some time to read about your insurance coverage before you need it. If you don't have a copy of the plan call Marsh and request a replacement. The plan is frozen, so no new policies are offered.

From UFOA - Catastrophic Insurance Claims: When you are a participating member with medical bills of $10,000. or more for health care related to an accident or major illness, you become eligible to receive payment after your basic medical insurance plan has exceeded its limit. UFA and UFOA members can call 800-503- 9230 for more information. The plan pays up to 100 % of eligible expenses and the deductible can be satisfied by basic health insurance or out of pocket expenses. The out of pocket expenses are covered for 3 years. Claims are sent to AIG Benefit Solutions, PO Box 1130, Beattyville, KY 41311

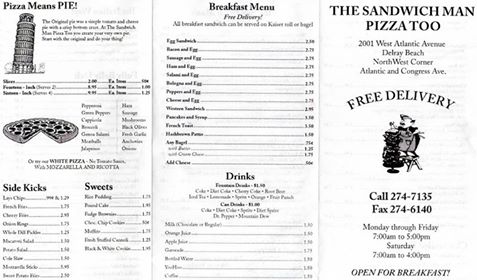

Support Those Who Support Us.

At

previous meetings we had two six foot heroes provided at no cost to us by

"The Sandwich Man" in Delray beach. They have

provided their sandwiches to our group on other occasions and refused to accept

payment. They make the best sandwich in the area and everyone remarked about

their great bread.

At

previous meetings we had two six foot heroes provided at no cost to us by

"The Sandwich Man" in Delray beach. They have

provided their sandwiches to our group on other occasions and refused to accept

payment. They make the best sandwich in the area and everyone remarked about

their great bread.

"You would think you were back in New York!".

We are asking you to please give the Sandwich Man your business, especially when catering a party but he also makes a great overstuffed sandwich, pizzas, and salads. Address 2001 West Atlantic Ave., Delray Beach, FL (N/W corner of Atlantic and Congress) Call 274-6140. Let's support those who support us! When you buy tell him your with the Palm Beach FDNY group.

Activities

from previous years.

Activities

from previous years.

Click on the year to see those photos

*******************************************************************************************************

The UFA Security Benefit Fund has increased benefits for hearing aids, eye glasses, and dental services, as well as expanded pharmacy's that accept our plan.

The Hearing aid benefit has been raised to $1000.00 every three (3) years. Up from $600 every 5 years.

Dental services through Florida Dental - HealthPlex S200, has expanded to areas in South Florida, including Broward and Palm Beach Counties. You can reach them at 1.888.200.0322 or www.healthplex.com

Eye glass info… we have a pretty full list of participating Private Practice Eye Doctors. Including Florida (too many to list here), so reach out to us and we can get you a list. The Optical benefits for retirees are as follows:

Eye exams $30, up from $15 - Lenses $50, up from $25

Frames $50, up from $20 - Contacts $100, up from $45

Annual Maximum $130, up from $60 *and it's for every OTHER year

Cataract Reimbursement (after Medicare Pays) is now $150, up from $75

You can now use "ANY" pharmacy* for prescriptions, not just CVS/Caremark. *Though I would suggest you shop around for pricing as different chains (i.e.: CVS, Walgreens, Rite Aid, Duane Reade, Walmart, Publix, etc.) have different prices.

At age 65, or two years after you become eligible for Social Security Disability Insurance regardless of your age, you MUST sign up for Medicare Part A & Part B 1.212.306.7610.

If you are enrolled in Medicare, because of a disability, you MUST also contact the UFOA Family Protection Plan to be enrolled in the PROPER Drug Benefit program. 1.212.376.8400.

Once enrolled in Medicare Parts A & B, you MUST contact Office of Labor Relations to sign up for the Medicare Part B Reimbursement Program.

Note: The Medicare Reimbursement check is now sent to the account where your pension money goes to. It is no longer sent by check. Check your bank statements for correct payment.

Click on graphic below for explaniation

![]()

To receive a Health Plans - Plan Summary Description 1-212-513-0470.

![]()

At age 70-1/2, you MUST start taking minimum required distributions from any qualified plans. Including your 401K's and UFOA Annuity Plan. **There is a 50% penalty if you do not!!!

RETIRED FIREFIGHTER SECURITY BENEFIT FUND

Click on blue topic to link to that info

UFOA Dental Providers ...........UFOA Dental Benefit Chart ..........UFOA Optical Plan Info Click Here

*Notification Upon Death Guide ..........*Catastrophic Claim Form .........* UFA Members Catastrophic Form

*Cobra Insurance .........*Medicare Info ..........*Retired FF SBF Summary......*Understanding the NYC Heart Bill

*Surgical Asst Form..........*UFOA Hypertension Screening Program

*W.T.C Related Cancers..........*W.T.C. Health Compensation Programs .... Medicare handbook

To get a Claim Form For UFA Catastrophe Ins. Call: 1-800 348-6908

Grants for Seniors ..........Cold War Recognition Certificate for Veterans

Medical Forms - Sal D`Angelo 1.917.440.3087

Blue Cross 1.800.433.9592 - G.H.I. 1.212.501.4444 - HIP 1.800.826.1013 - HealthPlex (Dental) 1.888.200.0322

UFOA Telephone Information 1.212.293.9300 - UFOA Family Protection Plan 1.212.376.8400

UFOA Retiree Rep. Pat Reynolds 1.212.376.8400

Medicare Part B - Customer Service 1.800.333.7586 - WTC FDNY Program 1.718.999.1858

Article 1-B Pension Check Trace 1.718.999.2327 - Article 1-A Pension Check Trace 1.718.999.1207

Life Insurance (FDNY) 1.718.999.2329

UFA 1.212.683.4UFA (4832) - UFA Security Benefit Fund 1.212.683.4SBF (4723) - UFA Retiree Rep. James Dahl 1.212.683.4723

FDNY Death Notification 1.718.999.2715

City of NY Employee Health Benefits 1.212.513.0470 OR 1.212.306.7300 OR 1.212.306.7600 - Fax 1.212.306.7756

General Prescription Plan 1.800.341.2234 - CVS Caremark Prescriptions 1.888.769.9030

Silver Scripts Prescriptions .......1.866.235.5660 (Last Names Starting with A-M) OR 1.866.412.5373 (Last Names Starting with N-Z)

The following appeared in the NYPD NE 10·13 Club May 2014 Newsletter MEDICARE/GHI Medicare beneficiares need not be concerned with the doctor being GHI participating doctor. Generally, upon visiting a doctor you are asked by one of his gatekeepers to present your insurance cards. At that point the patient is usually told ''we do not participare in GHI" your response should be; "What has that to do with me'? Then proceed to explain FEDERAL LAW to them. If you are on traditional Medicare the following applies.

- Medicare determines the sededule of payment to the doctor then pays 80% of the scheduled fee.

- Medicare than informs the supplemental secondarv insurer, (in our case GHI) what the remaining 20% is.

- The supplemental insurer, in compliance with FEDERAL LAW, pays the amount determined by Medicare.

That supplemental/secondary insurer can be GHI or "JOE GILTS" insurance company so long as the insurance company is acceptable to Medicare it makes no difference who the insurer is.

THEREFORE, MEDICARE BENEFICIARIES NEED NOT SEARCH FOR GHI - PARTICIPATING DOCTORS ANYWHERE.

There is another issue Medicare recipients need to be aware of. If you check your GHI card you will see a list of co-pays.

THEY DO NOT APPLY TO MEDICARE BENEFICiARIES.

There is a sentence just below the list of co-pay which reads: "The above co-pay do not apply to Medicare Beneficiaries". Very often an overzealous or just plain gatekeeper will demand the co-pay. Tell them to read the card and do not pay any co- pays.

A third issue Medicare beneficiaries should be aware of our annual deductible. The Medeicare deductible in 2014 is $147.00 per person. In addition we have a $50.00 deductible on our Supplemental (GHI). Often, particularly early in the year, a gatekeeper will ask if you have met your deductible. It is a violation of federal law to ask that question. Tell them that. Early in the year a gatekeeper may try to collect the deductible up front. Refuse to pay it, as it is against federal law for them to even ask. This is how it works, the doctor submits his statement Medicare. Medicare determines the fee schedule and what part is applied to your deductible. The same goes for your supplemental secondary carrier (ORI). The Explanation of Benefits (EOB) you subsequently receive from both will inform you of the payments you're responsible for. You should then reconcile your EOBs with your doctor's statements. Don't pay doctor bill until you have seen your EOBs from Medicare and GHI.

Catastrophic Insurance

If any member still has the Catastrophic Insurance plan that was offered to us through the union, PLEASE note that it is imperative that you keep the plan up to date and premiums paid BY THE DUE DATE!

The plan is no longer offered and if you let the plan lapse by a missing or late payment, you WILL BE DROPPED and NOT be able to get back into it!

This plan has been touted by those who have needed to use it to be a financial life saver, so for those who still have it, DO NOT risk losing it! 1.800.503.9230

Retired UFOA members will find the payroll deduction on their quarterly pension statements IF they have enrolled in this option. The acronym is CHIP Misc. UFA members do not have this option.

![]()

Information about the Medicare reimbursment

We know that if a member's spouse dies, he/she just notifies MARSH of the death and to remove that spouse from the policy.

But what happens if the member dies? I was told by a MERSH representative that the spouse must notify them within 31 days of the members death that she wishes to continue the policy. She would then set up the payment schedule either with a credit card or electronic transfer.

It is vital that she make this notification. She should call MARSH at 1-800-503-9230

Here is the reply from Patrick Reynolds who is the Retiree Liaison Uniformed Fire Officers Family Protection Plan about this issue......

"A surviving spouse can purchase the Catastrophic coverage on their own when a member pre-deceases the spouse. Payment would be arranged through a billing invoice as was explained in your email.

The UFOA does not manage the premium deduction, it is managed by Mercer (Formerly Marsh) in agreement with the City's pension payroll. Payments go directly to Marsh. UFA members do not have pension payroll deduction at this time for catastrophic insurance. When a UFOA member dies and there is a surviving spouse, they are advised of this benefit. I will pass your e mail on to the UFA's retiree liaison for his information and as to what the UFA provides. I would think these policies are the same as many members who are promoted retain the benefit."

Retired UFOA members will find the payroll deduction

on their quarterly pension statements IF they have enrolled in this

option. The acronym is CHIP Misc. UFA members do not have this option.![]()

-------------------------------

UFA Forms Online (clickl on page)

--------------------------------------------------------------------------------------------------------

Find and Compare Hospitals A Medicare Feature